Southwest Machine Technologies: Providing High Quality Products at Unmatched Value with Unrivaled Support

The global waterjet cutting machine market reached $1.41 billion in 2025 and is projected to expand to $2.20 billion by 2032, growing at 6.6 percent annually according to recent industry analysis. North America commands over 40 percent of worldwide market share, with the United States waterjet equipment sector specifically projected to grow from $305 million in 2024 to nearly $400 million by 2033. Texas ranks among the leading industrial states driving this expansion, with the state’s diversified manufacturing base in oil and gas equipment, metal fabrication, aerospace, and construction creating sustained demand for precision cutting technology that preserves material integrity.

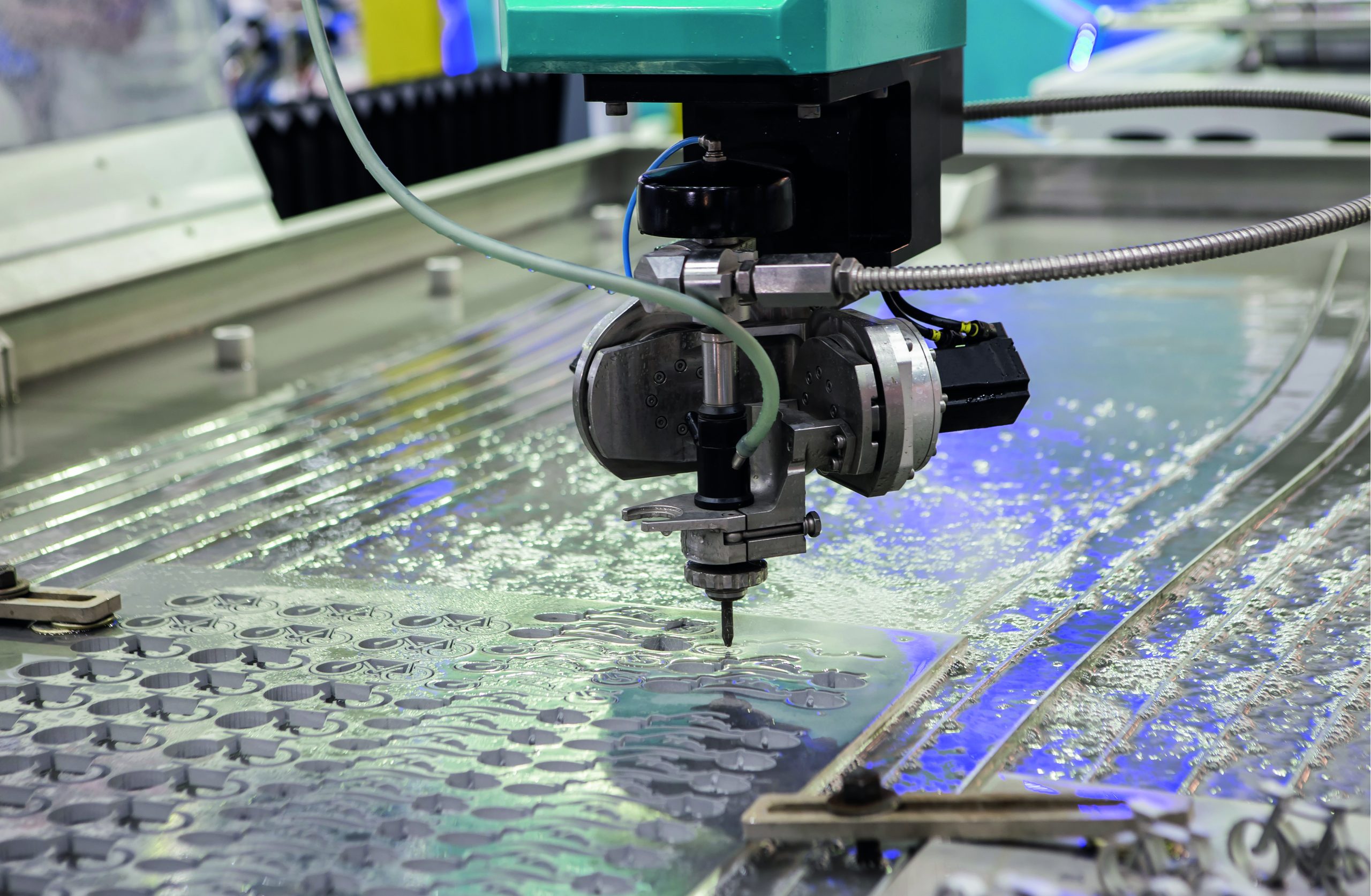

Waterjet cutting technology has emerged as a critical capability for manufacturers requiring precision processing across diverse materials without the thermal distortion associated with plasma, laser, or flame cutting methods. The technology accelerates water to supersonic speeds—often mixed with abrasive garnet particles—to cut through metals, composites, stone, glass, and virtually any material with tolerances measured in thousandths of an inch. For Texas fabricators serving aerospace contractors, energy equipment manufacturers, and precision component customers, waterjet systems deliver cutting versatility that single-technology shops cannot match.

The technology adoption aligns with broader equipment modernization trends reshaping Texas manufacturing. As detailed in Texas Manufacturers Face Equipment Modernization Pressure as Production Activity Accelerates, production output surged while employment remained flat—evidence that capacity expansion increasingly depends on equipment capability rather than workforce growth. Waterjet systems contribute to this productivity equation by enabling shops to process work previously requiring outsourcing or multiple cutting technologies, consolidating capabilities that improve throughput and reduce lead times.

Cold Cutting Advantages Drive Adoption

The fundamental distinction separating waterjet cutting from thermal processes lies in heat-affected zones—or rather, their absence. Plasma, laser, and flame cutting generate temperatures exceeding several thousand degrees, creating metallurgical changes in material adjacent to cut edges. These heat-affected zones can alter hardness, introduce brittleness, cause warping, and compromise material properties that engineers specified for performance reasons. Aerospace components, medical devices, and precision mechanisms cannot tolerate these thermal effects without risking performance degradation or premature failure.

Waterjet cutting eliminates thermal distortion entirely because the process generates no significant heat at the cutting interface. The Fortune Business Insights waterjet market analysis identifies cold cutting capability as a primary driver of technology adoption, noting that manufacturers increasingly demand precision processes preserving material integrity without thermal effects. This characteristic makes waterjet essential for cutting heat-sensitive materials including titanium alloys, tool steels, and advanced composites where post-cutting heat treatment or stress relief would otherwise be required.

Material versatility extends waterjet applications beyond traditional metal fabrication into diverse industrial sectors. A single waterjet system can cut aluminum for aerospace applications, stainless steel for food processing equipment, glass for architectural installations, and rubber for gasket production—all without tool changes or equipment reconfiguration. This flexibility proves particularly valuable for job shops and contract manufacturers serving varied customer requirements, enabling them to accept work across multiple industries rather than specializing narrowly in materials compatible with single cutting technologies.

Edge quality from waterjet cutting frequently eliminates secondary finishing operations required after thermal processes. Cut edges emerge smooth and burr-free, often ready for welding, assembly, or final use without grinding, deburring, or machining. This process efficiency reduces total manufacturing time and cost while improving consistency across production quantities. For Texas manufacturers competing on delivery speed and price, the elimination of secondary operations translates directly into competitive advantage.

Texas Industrial Base Drives Regional Demand

Texas manufacturing diversity creates waterjet demand across multiple industrial sectors simultaneously. The state’s energy industry requires precision-cut components for drilling equipment, pipeline fittings, valve bodies, and processing machinery. Aerospace contractors throughout the Dallas-Fort Worth and Houston regions need complex titanium and aluminum parts for aircraft structures and engines. Construction equipment manufacturers demand heavy steel fabrication with the precision that waterjet technology delivers for critical load-bearing components.

The Coherent Market Insights waterjet analysis documents that automotive applications dominate overall waterjet equipment demand in 2025, with aerospace, metal fabrication, and construction representing additional major market segments. Texas manufacturers serve all these sectors, creating concentrated regional demand for waterjet capabilities that support production across diverse customer requirements. Shops investing in waterjet technology position themselves to pursue opportunities across multiple industries rather than depending on single-sector demand cycles.

The 3D waterjet cutting segment commands 42 percent of market share, reflecting growing demand for complex geometry processing that two-dimensional cutting cannot address. Five-axis waterjet systems manipulate cutting heads through multiple angles simultaneously, producing beveled edges, compound cuts, and three-dimensional shapes from flat stock. Texas manufacturers serving aerospace and energy customers increasingly require these capabilities for components with complex geometries that would otherwise demand expensive five-axis machining operations.

Texas’s pro-business environment and infrastructure advantages amplify equipment investment returns. Manufacturers benefit from lower operating costs, favorable tax treatment, and logistics connectivity that enhance competitiveness against rivals in higher-cost regions. Equipment investments that improve capability and efficiency compound these structural advantages, enabling Texas shops to win work from customers throughout North America who might otherwise source locally or offshore.

Technology Integration and Automation Trends

Modern waterjet systems integrate extensively with CNC controls, CAD/CAM software, and production management systems that optimize cutting efficiency while reducing operator intensity. Nesting software automatically arranges parts on material sheets to minimize waste, often achieving material utilization exceeding 90 percent on complex part mixes. Cutting path optimization reduces head travel time between cuts while managing pierce sequencing to prevent part movement during processing. These software capabilities transform waterjet from a standalone cutting tool into an integrated manufacturing system generating data for production planning and quality documentation.

Hardware innovations continue expanding waterjet capabilities and economics. Ultra-high-pressure pumps exceeding 90,000 PSI enable faster cutting speeds and improved edge quality compared to earlier generation equipment operating at lower pressures. Abrasive delivery systems precisely meter garnet consumption, reducing operating costs while maintaining cut quality. Automatic head height sensing compensates for material variations, maintaining optimal standoff distance without operator intervention. Each advancement improves the cost-per-part economics that determine waterjet competitiveness against alternative cutting technologies.

The relationship between waterjet and CNC machining technologies deserves attention from manufacturers evaluating equipment investments. As examined in CNC Machine Market Surges Past $100 Billion as Texas Shops Invest in Precision Equipment, precision machining demand continues accelerating across Texas manufacturing. Waterjet cutting frequently serves as an upstream process producing near-net-shape blanks that CNC machines finish to final specifications. Shops operating both technologies capture more value from customer work while controlling quality throughout the manufacturing sequence.

Maintenance and consumable economics factor significantly into waterjet ownership calculations. Cutting heads, orifices, mixing tubes, and high-pressure seals require periodic replacement based on operating hours and cutting conditions. Abrasive garnet represents the largest ongoing consumable expense, with consumption rates varying based on material thickness, cutting speed, and quality requirements. Manufacturers evaluating waterjet investments should model total operating costs including consumables, maintenance, and utilities alongside capital equipment expenses to understand true cost-per-part economics.

Application Diversity Across Texas Industries

Aerospace manufacturing represents a particularly strong waterjet application in Texas given the state’s concentration of aircraft production, maintenance, repair, and overhaul facilities. Titanium, Inconel, and aluminum alloys used extensively in aerospace applications cut cleanly with waterjet while resisting efficient processing through many alternative methods. The absence of heat-affected zones satisfies aerospace quality requirements that often prohibit thermal cutting methods for flight-critical components. Aerospace contractors increasingly specify waterjet cutting in manufacturing planning, creating demand that equipped shops can capture while competitors lacking capability cannot pursue.

Energy sector applications span equipment manufacturing, maintenance, and field fabrication throughout Texas oil and gas operations. Valve bodies, flange blanks, and pressure vessel components require precision cutting from materials including carbon steel, stainless steel, and specialty alloys. Waterjet capability enables shops to process these diverse materials without maintaining multiple cutting technologies, simplifying operations while expanding addressable markets. Field service applications benefit from portable waterjet systems capable of on-site cutting for maintenance and repair work where shop fabrication proves impractical.

Architectural and artistic applications represent growing waterjet markets as designers specify intricate patterns in stone, metal, and glass that only waterjet can economically produce. Texas construction growth generates demand for custom architectural elements including lobby features, facade panels, and decorative metalwork. Shops positioned to serve architectural markets diversify revenue beyond industrial manufacturing while commanding premium pricing for design-intensive work requiring programming expertise alongside cutting capability.

Food processing equipment manufacturing benefits from waterjet’s ability to cut stainless steel cleanly without contamination concerns associated with some cutting processes. Texas food processing operations require equipment fabrication meeting sanitary standards that waterjet cutting supports through clean edges and absence of thermal effects that might compromise corrosion resistance. This application illustrates how waterjet capabilities open market opportunities that shops limited to thermal cutting methods cannot address.

Investment Considerations for Texas Fabricators

Equipment selection involves tradeoffs between capability, cost, and operational requirements that each manufacturer must evaluate based on their specific circumstances. Entry-level waterjet systems provide basic cutting capability at lower capital costs but may limit cutting speed, material thickness capacity, or precision compared to higher-specification equipment. Production-focused systems designed for industrial throughput command premium prices but deliver economics that justify investment for shops with sufficient volume to utilize capacity.

Table size determines maximum part dimensions and influences material handling efficiency for production operations. Larger tables accommodate bigger workpieces while enabling efficient nesting of multiple smaller parts that maximize material utilization. However, larger tables require more floor space, higher pump capacity, and greater capital investment. Manufacturers should evaluate typical part sizes and production volumes when specifying table dimensions rather than defaulting to maximum available sizes.

Pump pressure and horsepower directly affect cutting speed and edge quality, with higher specifications enabling faster processing of thick materials while potentially improving surface finish. Ultra-high-pressure systems cutting at 90,000 PSI or above achieve speeds approximately 50 percent faster than standard 60,000 PSI equipment on equivalent materials, improving throughput economics for production applications. The pressure decision involves balancing capital cost premiums against operating efficiency gains based on anticipated production requirements.

Southwest Machine Technologies: Your Texas Waterjet Equipment Partner

Southwest Machine Technologies serves manufacturers across all 254 Texas counties with industry-leading fabrication equipment and comprehensive service support. Our CMS waterjet systems—including the Tecnocut Smartline, Proline, and Aquatec platforms—deliver precision cutting capabilities engineered for demanding production environments.

Our Fabrication Equipment Solutions Include:

- Fabrication Machines – CMS waterjet cutting systems and Cosen saws providing versatile material processing for Texas manufacturers

- Complete Equipment Integration – Waterjet systems complementing milling, turning, and sawing equipment for comprehensive fabrication capabilities

Ready to Expand Your Cutting Capabilities? Contact Southwest Machine Technologies to discuss how waterjet technology can diversify your fabrication capabilities and position your operation for growth across Texas manufacturing’s expanding markets.

Works Cited

“Waterjet Cutting Machine Market Analysis & Forecast: 2025-2032.” Coherent Market Insights, 29 Jul. 2025, www.coherentmarketinsights.com/market-insight/waterjet-cutting-machine-market-3290. Accessed 9 Dec. 2025.

“Waterjet Cutting Machines Market Size, Share & Industry Analysis.” Fortune Business Insights, 24 Nov. 2025, www.fortunebusinessinsights.com/waterjet-cutting-machines-market-102026. Accessed 9 Dec. 2025.

Related Articles

- Texas Manufacturers Face Equipment Modernization Pressure as Production Activity Accelerates

- CNC Machine Market Surges Past $100 Billion as Texas Shops Invest in Precision Equipment